USAWatchdog.com -

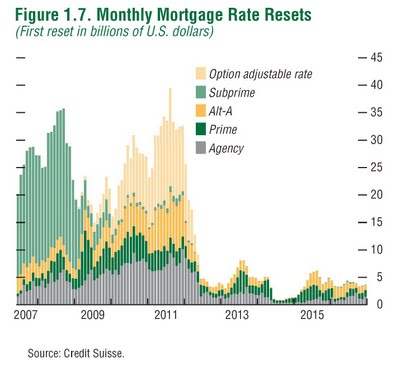

On Christmas Eve of 2009, the Treasury decided to lift the caps on how much bailout money failed mortgage giants Fannie Mae and Freddie Mac would receive to stay in business. The caps represented a maximum taxpayer exposure of $400 billion for both companies. Now, taxpayers will be on the hook for an “unlimited” amount for, at least, the next three years. How much is “unlimited?” Well, for starters, Fannie and Freddie guarantee more than $5 trillion in mortgage backed securities. Add that to the combined debt of nearly $3 trillion for both companies, and you get $8 trillion of taxpayer liability. When I first heard that the caps would be lifted for just three years, I asked myself “Why three years?” The chart below gave me the answer. Take a look at the 2010 mark. You see that wave of mortgage resets for all those different kinds of mortgages? They peak and fall off about mid 2012.

You know the reset mess won’t be over at that precise point. It will take about six months or so for all the defaults to shake out. That’s just about three years, which is the exact same amount of time the caps on Freddie and Fannie will be lifted to bail them out of infinity. I am confident Treasury Secretary Geithner has seen the same chart. He knows those bars represent millions of mortgages. Not everybody will default because their mortgage resets, but many will not be able to afford the higher payments and lose their home.

Also, Fannie and Freddie are going to have to keep providing hundreds of billions of dollars in new mortgage financing because, if they don’t, the real estate market will probably collapse. With all the sour mortgages, securities, and new mortgage exposure, there is no telling how much this will cost the taxpayers. I don’t think it is a stretch to say it will end up being many trillions of dollars. Once again, there was a huge tax bill hung on the country, on Christmas Eve no less, and the mainstream media is nowhere to be found. Where is CBS, NBC, ABC, and CNN? What just happened to the budget deficit is bigger than the $700 billion TARP bailout, the $787 billion stimulus bill, and the $180 billion bailout of AIG, COMBINED. As a matter of fact, lifting the caps on Fannie and Freddie will cost many times more than all those COMBINED! I guess that is just not a story in mainstream media land.

On Christmas Eve 2009, an $8 trillion addition to the federal debt was made by a single bureaucrat. This move by the Treasury is a budget buster and will guarantee some very big inflation. Gold will react to higher inflation with higher prices. There was only one other time in the last 10 years that there was such a clear signal precious metals were in for a ride. It was March 2006, and brand new Fed Chief, Ben Bernanke, decided to call an end to the M3 report. (a statistic that shows the broadest measure of all money in the system). The Fed effectively said it was not going to tell the world exactly how much money it was creating. You might as well have walked into the gold trading pits with a starting pistol because, after the M3 died, gold just about doubled in less than four years. Just look at the chart below:

Now, with the elimination of the caps on mortgage giants Fannie and Freddie, you will have gold off to the races again because the government will print money to pay off debt. And if we have another financial meltdown, like 2008, gold will take a moon shot. What makes me say that? It is H.R. 4173, which is the Reform and Consumer Protection Act of 2009. This legislation is supposed to protect the little guy, but it also protects the banks with a provision in the bill to rescue them from financial ruin in the future. The Fed will have pre-authorization to give reckless banks as much as $4 trillion to, once again, bailout the incompetent. The bill has a long way to go before it is signed into law. Still, I’d say the odds are pretty good there will be another crisis; otherwise, Wall Street would not have paid their lobbyists to push a pre-authorized bailout.

My advice to you is to brace yourself for the impact of inflation. The actions of the Treasury and Wall Street have guaranteed it.

No comments:

Post a Comment